Overview

DeHedge offers an infrastructure that can protect cryptocurrency investors

DeHedge is the decentralized risk-hedging platform for cryptocurrency investors. DeHedge hedges investments in ICOs and cryptocurrencies, safeguarding investors in case of exchange rate fluctuations, scams, and project cancellations.

Links

Project

Token Details

Symbol : DHT

Type : ERC20

Token Price : 1 DHT = $0.020625

Accepted Currencies : ETH, BTC

Classification : Utility Token

Decimals : Not Specified

Token Sale Company :

ICO Start Date : Apr 03, 2018

ICO End Date : Apr 30, 2018

Token Distribution : Within 48 hours or less after ICO sale ends

Hard Cap : $30,000,000

Total Tokens : 10,000,000,000 DHT (2,500,000,000 (two and a half billion) Tokens will be offered for placement during the ICO)

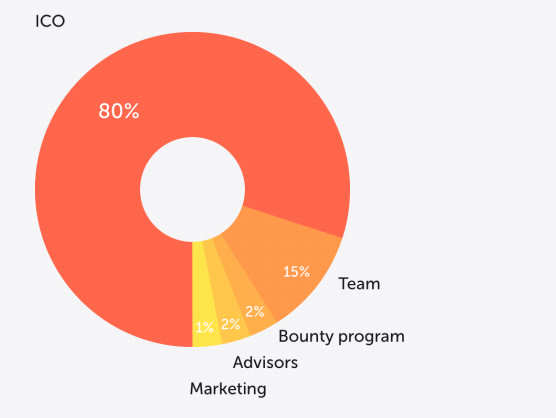

Token Distribution

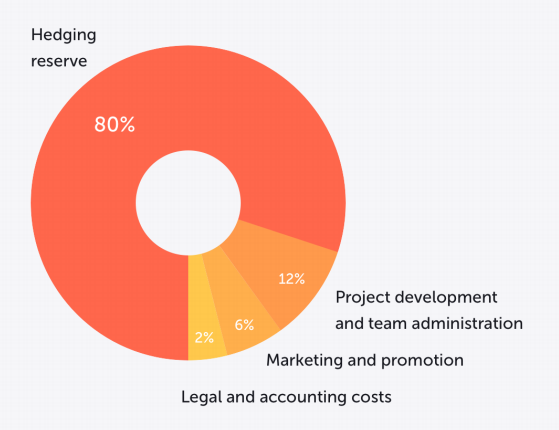

Budget Allocation

Team

| Mikhail Chernov | Founder & CEO | in |

| Bogdan Leonov | Co-Founder & CCO | in |

| Dmitry Ansimov | Co-Founder & COO | in |

| Mark Feldman | Investment Director | in |

| Vasilii Artemev | CTO | in |

| Ilya Makhnachev | Senior Trader | in |

| Maria Andrianova | Head of Legal | in |

| Roman Bruskov | Editor-in-Chief | in |

| Minh Duong | Investment Director | in |

| Frederic Moulinou | Financial Analyst | in |

| Angie Mingazova | International Relations Liaison | in |

| Kamil Vildanov | Marketing Director | in |

| Danil Lakhomov | Head of Digital-Marketing | in |

| Anton Repnikov | Head of PR | in |

| Yunus Zaytaev | Software Engineer | in |

| Rafael Bogaveev | Software Engineer | in |

| Evgeny Novikov | Financial Analyst | in |

| Jeremie Henicz | Financial Analyst | in |

| Minck Vos | Ambassador for DeHedge in Amsterdam | in |

| Henrick Andersen | Ambassador for DeHedge in Singapore | in |

| Eeshan Kulkarni | Ambassador for DeHedge in Singapore | in |

Roadmap

2017

Q2

- Formation of the Investment Research team and the Data Science department;

- Start of the development of a scoring model.

Q3

- Testing the scoring model.

Q4

- Development of a platform for hedging risks of investors in ICO projects;

- Start of work of the investment committee (formation of a collegial expert investment committee).

2018

Q1

- Launch of the Beta version of the platform;

- Test hedging ICOs;

- Launch of the investor’s Personal Account within the framework of the DeHedge ICO;

- Completion of registration procedures in accordance with US law (Regulation D) for the sale of tokens in the United States to American qualified investors;

- Development of a platform for hedging tokens on the secondary market;

- Private / Public Pre-Sale;

- Establishment of partnerships with underwriting pools and liquidity providers;

- Road Show.

Q2

- Testing the platform for token hedging on the secondary market;

- Calibration of the existing scoring model;

- Road Show;

- ICO Main Sale;

- Obtaining the license for an operational company for the core business financial services;

- Launch of the hedging platform for tokens on the secondary market;

- Formation of the secondary market risk management system

- Testing options desks on a real portfolio of market risk with the development of a strategy for dynamic DH risk hedging;

- Building front-to-back business processes;

- Launch of test analytical coverage of significant ICOs and events affecting the dynamics and cost of crypto assets (available to a limited number of subscribers);

- Building cross-cutting, front-to-back business processes to integrate investment research and scoring into the DH risk management system;

- Formation of partnerships with mining pools;

- Launch of underwriting and consulting services.

Q3

- Launch of the DeHedge research portal;

- Launch of a product to hedge the risks of mining farm buyers from exchange rate fluctuations;

- Completion of automation of front-to-back business processes;

- Publication in the investor’s Personal Account of the first pool of tools available for hedging with DHTs;

- Launch of the platform Telegram bot.

Q4

- Launch of hedging on alternative blockchains;

- Start of development of AI for project scoring;

- Launch of a mobile platform application;

- Registration of additional legal entities in the DeHedge group of companies for operations scaling purposes;

- Publication of periodic materials of investment research for a wide range of

investors

2019

Q1

- Start of development of a derivatives trading website (based on the decision of the investment committee in case of a shortage of instruments and toolkits on the main platform necessary to meet the needs of platform

Q2

- Launch of AI scoring;

- Development of a Beta version of the derivative platform with full functionality for hedging positions.

Q3

- Launch of a derivative platform with full functionality for hedging positions.

Contact

DEHEDGE GROUP LTD., (Registration number 11204957),

30 Vintage Court Cambridge Road, Puckeridge, Ware, United Kingdom, SG11 1SA